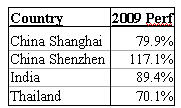

China/India alternative vs valuation

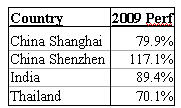

While China and India are definitely the flavor of the day and have had

amazing runs:

Source: Bloomberg

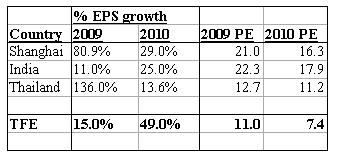

China and India have much more expensive valuations as a result (60-65%

higher P/E multiples):

Source: Bloomberg / Quest Management, Inc.

In reality, many Thai industrial companies which have little or no exposure

to the volatile domestic sector are excellent, world-focused, and can be

bought at a significant discount to Chinese or Indian companies because they

are overlooked and under-owned.

We believe that politics will be more stable in Thailand than in China over

the next five to ten years. As Chinese workers’ lifestyles improve and they

move up the hierarchy of needs, it is likely that they will feel

dissatisfied with their extremely regimented lifestyle and lack of personal

freedoms. Unlike China, Thais have enjoyed great personal freedom and

democracy for the last 77 years.

Earnings Growth and Capital Gains

When I arrived in Thailand over 20 years ago, Thai investors and brokers

told us not to waste our time trying to estimate the earnings of Thai

companies, because prices move on insider trading, not earnings.

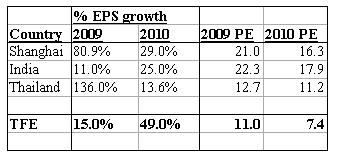

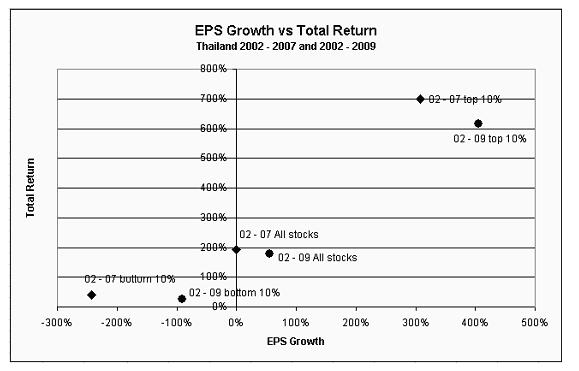

In a new study, we recently looked at all stocks listed from year-end 2002

until year-end 2007 (five years), to see the relationship between EPS growth

and total return (see below).

Earnings Growth vs Total Return

Source: Bloomberg & Quest Management

Of 220 stocks that had earnings per share (EPS) and price data, the top 10%

grew their earnings by an average of 308% and made an average total return

of 699%.

The worst earnings performance stocks drove average EPS from 0.33 baht per

share to a loss of 0.47 baht per share (-242% growth). This bottom 10% had

average total returns of only 41%.

The SET Index had a total return of 194%, so we can see that the Thai market

really rewards companies that produce big earnings growth and punishes

companies with bad earnings.

Data from 2003 until 2009 shows similar trends (see above).

What’s going on in the Thai Economy?

In terms of government stimulus, Thailand is much closer to the US rather

than the Chinese timetable. While the Thai government passed two huge

stimulus programs totalling $46 billion (18.4% of GDP), actual spending to

date only amounts to about $4 billion. In 2010, the budget calls for

spending about 5% of GDP. With this level of government spending in mind,

the consensus real GDP growth is 3.5% for 2010 and 4.5% for 2011.

In addition, macroeconomic policy after the 1997 currency crisis has forced

Thai banks to focus on basic banking business, so there are no banking

problems in Thailand.

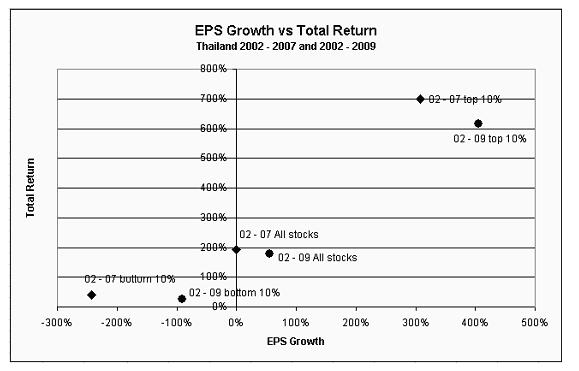

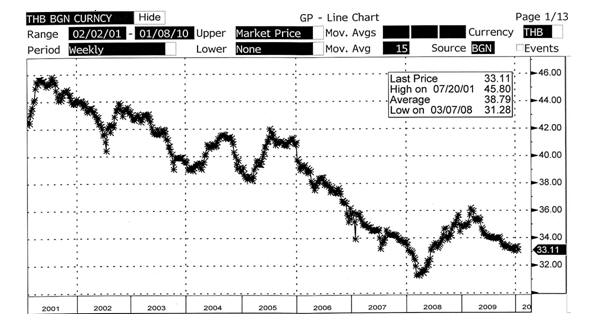

We also feel that, given the huge printing of US dollars with no underlying

economic activity, the Thai baht will continue to strengthen against the US

dollar.

Thai Baht per US Dollar

Source: Bloomberg

We think that dollar weakness will

also translate into higher commodity prices even in the face of moderate

demand, because commodities are traded in US dollars.

We believe that China and other manufacturing nations that have very large

US dollar surpluses are actively using those excess dollars (soon to be

devalued) to buy several years’ worth of raw material inventories.

This explains why we have oil at $79/bbl off a bottom of $30, zinc at $2,530

per ton off a low of $1,047, rice at $600/ton off a low of $300, and the BDI

shipping index at 3,000 off a low of 663.

It is also a brilliant strategy by manufacturers to lock in their largest

costs during a period of comparatively weak prices for future expenses that

that they know they will incur, while simultaneously diversifying out of the

US dollar.

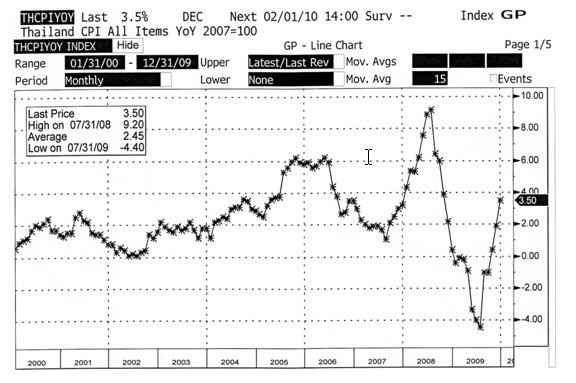

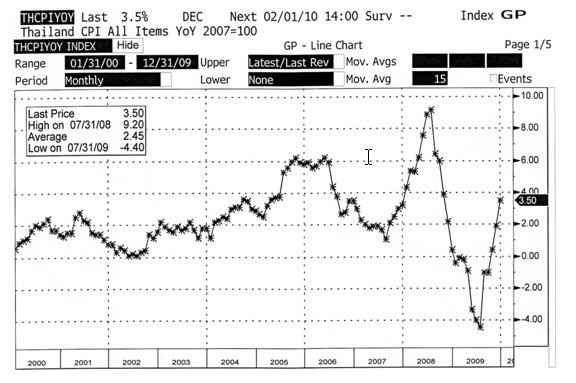

Inflation in Thailand is still low, due to the slower spending of the

government stimulus and substantial slack in manufacturing capacity

utilization (see below).

Thailand Consumer Price Inflation

Source: Bloomberg

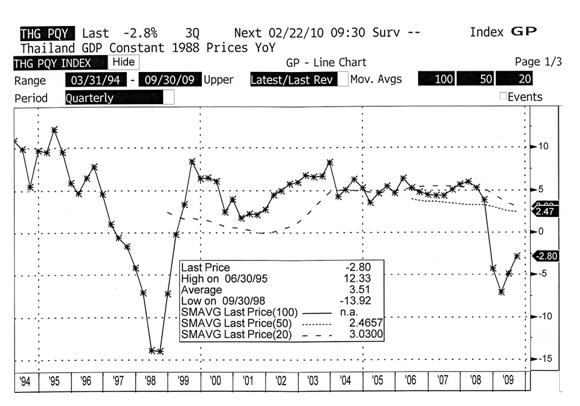

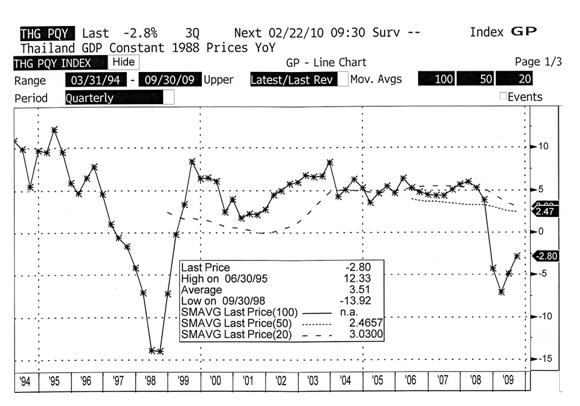

The big unknown is politics. Political uncertainty primarily affects the

retail and entertainment sectors, as well as infrastructure, because

consumers tend to pull back on spending and bureaucrats prefer to delay

action on major projects when there is no clear government leadership.

However, overall GDP growth under political uncertainty has held up very

well until the global banking meltdown in 2008 (see below).

Thailand Real GDP Growth YOY

Source: Bloomberg

This is why we prefer to avoid infrastructure, retail and

entertainment-related stocks at this time, as we believe they will bear the

brunt of negative consumer sentiment.

Although investors are bearish right now, we continue to maintain a very

substantial long exposure to the market because:

• Thai interest rates are lower than inflation, yeilding Thais a negative

real rate of return on deposits. We think Thais will therefore invest in the

stock market.

• The government stimulus program continues to inject massive liquidity into

the Thai economy. Liquidity almost always finds its way into stock prices.

• Thai companies have focused on reducing their fixed costs so that, even

though their revenues have dropped significantly, they are able to show a

net profit.

• A U.S./world recovery will be good for Thai exporters. Thai exports are

split evenly between Japan, Europe, and the US. Export companies that we

follow are currently trading at only 5.3 to 8 times earnings.

• Most importantly, stocks are cheap right now. The index is still 18.6%

below its November 2007 peak. And did I mention that the weighted average

P/E on 2010 earnings for our portfolio is now only 7.4x with 49% profit

growth?